Why should you constantly learn about emerging digital marketing trends as a financial marketer?

The answer is simple.

The competition in the financial services industry is getting fierce and experiencing constant expansion as new companies are coming into the field.

Besides, modern customers now have more demands than ever before.

Thus, to stand out and reach more potential customers, you need to have a solid digital marketing strategy that can help you get noticed, improve customer engagement, and gain their trust.

This is why as a financial marketer it’s vital to constantly stay on top of the latest digital marketing trends that can help you develop innovative campaigns to connect with potential customers.

This post shares the top four emerging digital marketing trends to help you stay competitive in 2023 and beyond.

Let’s get started.

Digital Marketing Trends for Financial Marketers

Here are the top four digital marketing trends finance marketing professionals must know about.

1. Personalization

Gone are the days when customers only had a few financial services options to choose from.

Today, that’s not the case.

A huge number of major retailers are all chasing customers with solid payment histories, steady incomes as well as frequent credit card use. They’re even dishing out referral incentives to get new customers.

And because customers have access to a host of choices, they have become less loyal.

As a result, key players in the financial services industry are forced to implement strategies that help them acquire and retain customers. And one of them is personalization.

To stand out from the crowd, financial services companies need to build brand value by competing based on customer experience.

Personalization enables financial services companies to be customer-centric rather than product-focused.

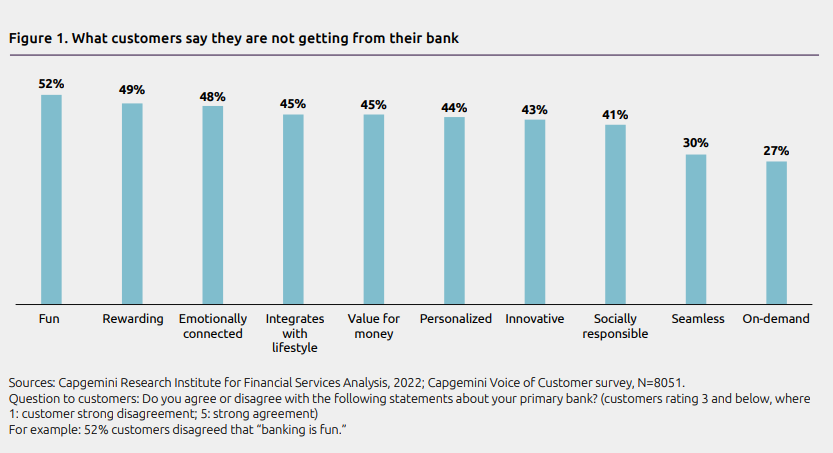

Yet, 44% of consumers say they aren’t getting personalized experiences from their banks:

44% of consumers say they aren’t getting personalized experiences from their banks.

Click To Tweet

When done right, personalization in financial services marketing can be beneficial in the following ways:

- Improve revenue by increasing engagement and conversion rates.

- Boost customer experience, loyalty, and retention.

- Facilitate consistent messaging across channels.

Arguably, personalization makes customers feel treated as individuals and not anonymous people. This way, they gain confidence in your business.

But personalization can only be achieved when financial services companies have access to valuable customer data.

This is where digital personalization tools with artificial intelligence can become helpful.

Here’s how to deliver personalization for your customers using these tools:

- Use digital personalization tools to collect and unify customer data that you can use to personalize messaging.

- Segment based on the buying cycle.

- Share personalized blog content and offer personalized offers.

- Utilize personalization strategies across channels.

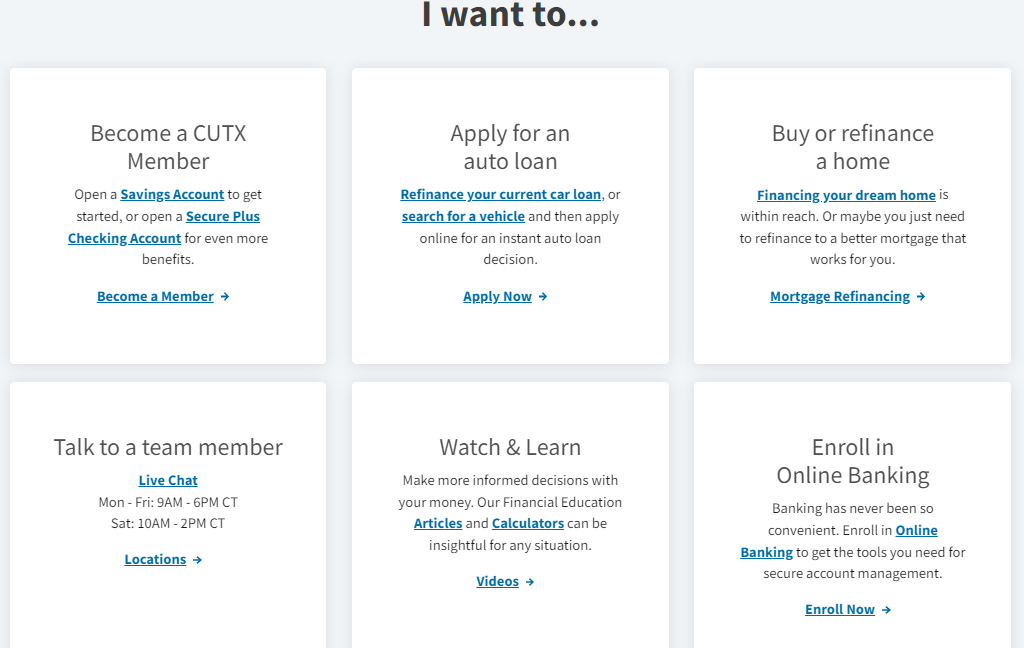

Take a look at how Credit Union of Texas has personalized their website:

When customers visit the website and click on their preferred option (become a CUTX member, apply for an auto loan, etc.), they are presented with a form to fill out.

The data is sent to the credit union’s CRM for lead tracking. The data is then used to create an audience profile that can help deliver personalized experiences based on the information the customer enters in the form.

2. Financial Services Companies Are Focusing on Digital

Modern customers want to access their finances 24/7 from any location, using any device.

To facilitate this, many financial institutions have gone digital and enabled customers to access their financial services online via desktop and mobile devices.

A 2022 Vericast Financial Services Trendwatch report shows that 82% of financial institutions are now investing in online and mobile banking, and 67% in new technology.

82% of financial institutions are now investing in online and mobile banking, and 67% in new technology.

Click To Tweet

What’s more?

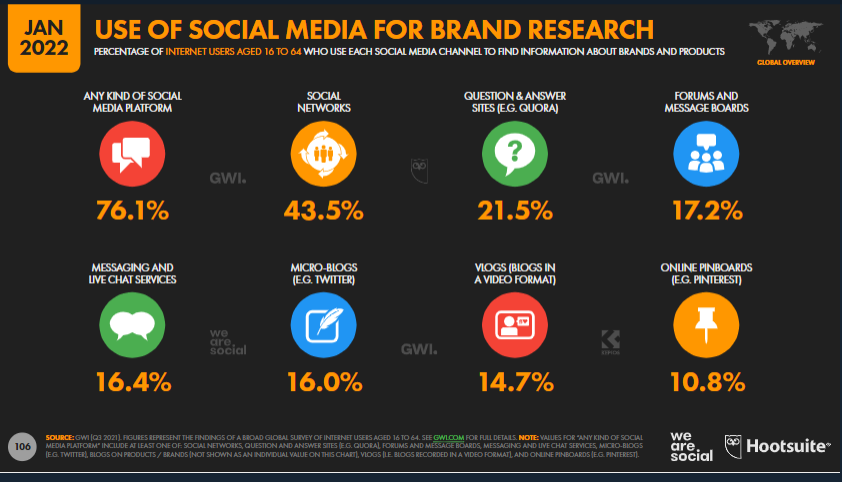

Since customers are spending more time on different social media platforms, maintaining a solid social media presence and engaging with potential customers is a great idea.

Remember that 76.1% of internet users use social media platforms for brand and product research.

By default, financial institutions are perceived to be impersonal. Ensuring an active social media presence can help you connect and interact directly with digital users and build a community around your brand.

Here’s how leveraging social media can benefit your brand:

- Reach new potential customers

- Enhance relationships

- Humanize your brand

- Uncover real business results

- Demonstrate brand purpose and nurture a community around your brand

- Uncover key industry and customer insights

Pro Tip: Use the best social media marketing software to make it easy to run effective strategies and achieve your goals. They can help with content scheduling, analytics, and more.

3. Content Marketing

Content marketing is also one of the key digital marketing trends for financial marketers.

But why?

Here are some of the benefits of content marketing in financial services:

- Drives brand awareness

- Provides a medium for educating current and prospective customers

- Helps build greater trust and stronger relationships between your brand and customers

- Enables brands to connect with potential customers

- Helps reach the younger generation

- Helps acquire and retain customers

- Content marketing is a practical lead-generation strategy

- Sets your company apart from competitors

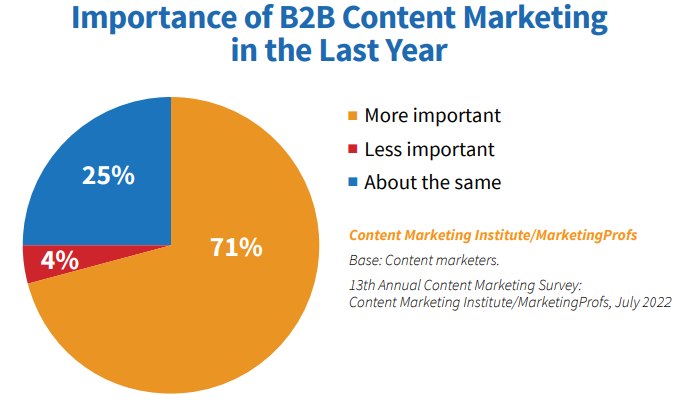

It’s no wonder then that 71% of B2B marketers say content marketing is more important than ever before.

This explains why financial services firms, entrepreneurs, and startups are all leveraging content marketing in their financial services marketing strategies.

Creating high-quality blogs, videos, podcasts, case studies, and other types of content can help support your SEO and email marketing efforts.

That, along with cheap email marketing software and SEO tools can help you supercharge your marketing campaigns.

And among content, what should you choose?

To set yourself apart from the competition, consider adding videos to your blog posts and landing pages.

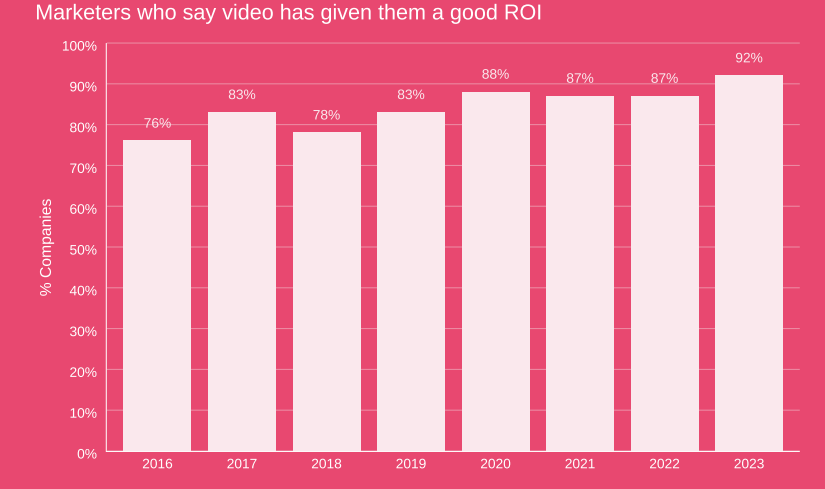

According to a recent Wyzowl Video Survey report, 92% of marketers say video has given them a good ROI.

92% of marketers say video has given them a good ROI.

Click To Tweet

The good news is that video editing cost doesn’t leave a dent in your wallet. In fact, you can use free video editing software to edit videos and add them to your blogs.

Here are handy tips to implement content marketing in financial services:

- Define your target audience and build detailed buyer personas

- Determine the content needs of each of your buyer personas

- Create content that addresses your audience’s needs and challenges

- Optimize your content for search engines and humans

- Create content that establishes you as a thought leader in the industry

- Focus on each stage of the buyer’s journey

- Boost organic content’s reach with paid campaigns

4. Chatbots

When they were first introduced, chatbots were seen as being impersonal. Today, AI-powered chatbots offer a convenient and effective way for financial services companies to provide 24/7 customer support.

According to research by Insider Intelligence, 40% of internet users prefer interacting with chatbots than with virtual agents.

This is especially a great idea given that modern customers value timely responses, and chatbots can enable that.

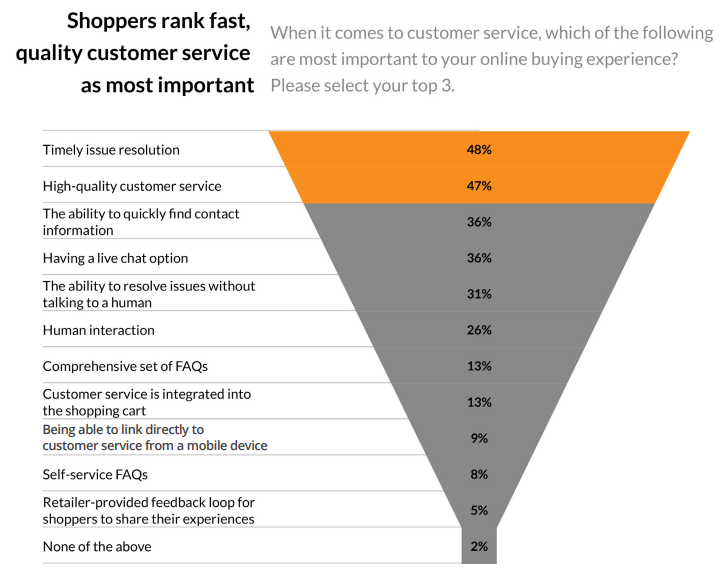

A recent survey report shows that 48% of online consumers say timely issue resolution is one of the most important factors impacting their online buying experience.

AI-powered chatbots are available 24/7 and can quickly respond to an unlimited number of questions from multiple users.

Plus, chatbots can send users to the FAQ or product page to help them or direct them to a customer representative for questions that need to be addressed by humans.

Conclusion

To stand out from the competition financial marketers must constantly stay on top of the latest digital marketing trends.

This will help you keep up with your audience’s expectations and never miss out on business opportunities.

These digital marketing trends for financial marketers should give you a picture of what to expect in the industry.

The post Emerging Digital Marketing Trends for Financial Marketers appeared first on Convince & Convert.