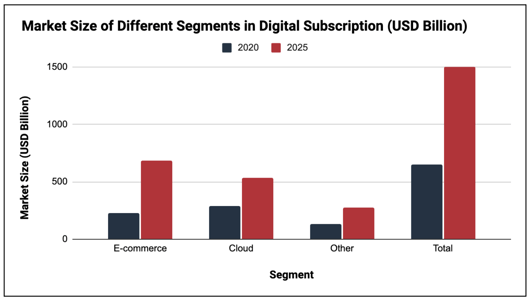

Anyone not living under a rock knows that subscription businesses are huge these days:

- The global subscription market is projected to reach $1.5T next year

- Three in four D2C companies have some form of subscription offering

- The combined market cap of all digital subscription companies has reached $14T (with new entrants still jumping in)

Source: UBS

But making a buck isn’t as easy anymore, especially since consumers today paying $1k per year on subscriptions seem to be outgrowing this model.

If there’s ever a “subscription apocalypse” – like everyone trading in their subs for a Tesla – the person you should call for help is Daniel Layfield.

Dan led growth at Codecademy from $10m to $50m ARR. He’s now sharing battle-tested growth wisdom at Subscription Index.

According to Dan, there are three questions to ponder about before you start considering a subscription business.

First, A Refresher

What we’re discussing here don’t include enterprise contracts, where you get paid millions a year by big clients. We’re referring to businesses that make most of their revenue via smaller, recurring payments from a large portion of users.

Now onto the questions:

1. How Long Would A Typical User Need My Solution?

For someone to pay for something repeatedly, they need to assume that they’ll get value from it across multiple uses.

A one-off purchase like a sandwich is a non-starter (unless you’re launching a wildly niche “mystery sandwich of the month” club…). But water supplied to your house is an excellent fit, because you’ll need it forever.

The ideal subscription business model has:

-

A long potential use case

-

A lot of potential customers

So don’t get excited by the promise of recurring revenue just yet.

Do your research, talk to potential users, and evaluate how long they’ll likely need your solution. That’ll help you estimate the ceiling for customer lifetime value (LTV).

Source: Dan Layfield

2. Where Do I Have The Most Opportunity?

In theory, you’d want to shoot for the highest revenue potential, or the top right quadrant on Dan’s graph.

But there are already massive, entrenched players operating in those spaces, making them difficult to compete in. Disrupting your local utilities company? Not an easy feat.

For newer, smaller companies, Dan sees the most opportunity in the medium-length use cases, such as:

- SaaS or specialized services

- Job training or skill development

- Dating

- Getting in shape

These needs often take several months to a few years to complete, giving you a nice runway of recurring revenue.

But your use cases should be at least three months long – shorter than that, you might as well charge for all the value upfront. You’ll be fighting churn HARD the whole time.

3. Can I Afford To Be Patient?

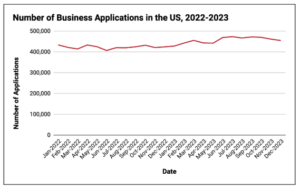

If you look at a list of the “fastest” growing SaaS companies, besides having a great product and great go-to-market skills, they’re usually B2B sales-led products.

Ramp grew 400% in a year because they could sell longer-term deals and collect more cash upfront.

Meanwhile, most consumer subscription businesses have to grind out more linear expansion over time – even the fastest growing players like Spotify scale their subscriber base in a gradual (yet consistent) way.

Source: Statista

This means you need to embrace a much longer runway and a more patient approach to building your business.

If you’re bootstrapping, keep costs tightly controlled since it may be a while before you see material revenue traction.

If you’re venture-backed, hire as lean a team as possible. Avoid the temptation to over-staff – you know how that ends.

So why stick with it if it’s such a slow grind?

Because subscription pricing also offers its unique set of perks.

The Benefits of Subscription Pricing

Recurring Cash Flow

Subscriptions will give you predictable cash flows, which eases the pressure on customer acquisition. You won’t need to constantly get new customers to make money.

If you can retain users for long periods of time, you can compound into a really large business because each month more recurring users get added to the user base.

High Valuations

The recurring cash flow tend to get you very high valuations, Dan says.

- Codecademy was making around $50m per year in 2021, and was bought for $525m later that year, getting almost a 10x multiple.

- Amazon bought PillPack for $1B in 2018. The startup was reportedly making around $100m in revenue the year before, getting a 9x-10x multiple.

Investors and private equity companies love subscription businesses because of the stable cash flow – unlike a business that’s dependent on new sales each month to generate revenue.

And if you can get churn lower than your organic user sign-ups, you have a business that will just grow from momentum.

Diversified Revenue Base

Since you have a lot of small transactions that make up your revenue base, your business is more durable across the long term.

This differs from enterprise B2B companies, which might earn half of their revenue from three large clients. If these clients leave, they’re in serious trouble. Because of this, consumer-facing subscription businesses can weather bad economies relatively well.

![]()

![Read more about the article Where to Invest in New Sales Tech for the Greatest Return in 2022 and Beyond [New Data]](https://www.dimaservices.agency/wp-content/uploads/2022/08/3934a25d-e58d-447e-a2ee-5505db8c56ea-300x105.png)