The growth of digital banking has left financial services brands with fewer opportunities for one-on-one interactions with their customers. As such, the brands are having a hard time driving customer loyalty and retaining loyal customers for their businesses.

The COVID pandemic has also contributed significantly to the growth of the digital self-service era. With almost all in-person activity going digital, banks and other financial institutions have been forced to rely on technologies to engage their users, one of them being AI.

However, the accelerated adoption of AI tools by financial institutions doesn’t necessarily mean that customers are no longer getting personalized experiences.

AI supports personalization to a great extent, allowing financial service providers to deliver the same level of customer service as in their pre-digital days, if not better.

This article examines how AI-driven personalization helps financial services firms to drive customer loyalty and improve their efficiency and profitability.

Let’s get started.

Why Personalization Matters in Financial Services?

Financial services is a highly competitive industry where the delivery of personalized services is no longer a “nice-to-have” option but a key customer expectation.

The good thing is that banks realized this early enough and have been working to customize their products and offers for customers.

The organizations are aware that while there are many providers with different offerings, those that get appreciated by users are those that cater to the individual needs of customers, and this is not achievable without personalization.

Data-driven personalization in financial services can be achieved in various ways. For example, a bank can segment its customers into different demographic groups for effective engagement.

By doing this, it becomes easier to target them with precise offers and fulfill the needs that are specific to each group such as:

- Top-notch account security for Baby Boomers

- Virtual banking and digital support for Gen Z

- A consistent supply of useful financial insights through explainer videos for Millennials

- Innovative banking technologies for Gen X

The adoption of personalization also fits seamlessly with the natural progression of events in the banking industry. The 60s saw the introduction of ATMs while card-based payments became popular in the 70s.

There were no noteworthy developments in the 80s and 90s. The 2000s was all about 24/7 banking and mobile banking became a thing in the 2010s.

It’s now time for the next step in the banking industry which is AI-driven personalization.

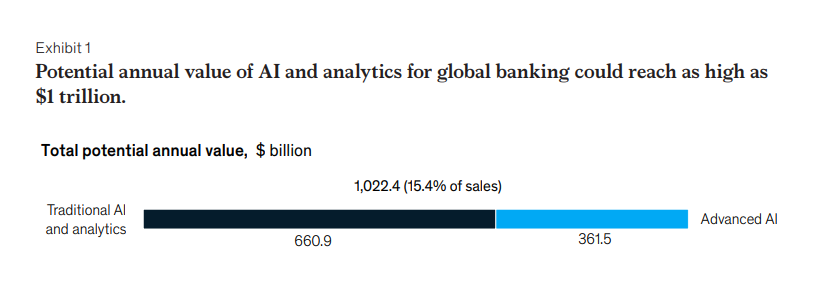

A McKinsey report on AI in the banking industry states that the value of AI in financial services can be more than $1 trillion every year.

By using artificial intelligence, financial institutions can achieve at-scale personalization, deliver omnichannel experiences such as contactless marketing, and create an innovation culture in their organizations.

These are just three key outcomes you can achieve with AI-powered personalization in financial services.

However, the talk isn’t just about the benefits of AI anymore but the indispensable nature of AI for financial institutions. The reasons why AI is an absolute necessity are:

- Rising user expectations as customers demand banks to use AI to improve their digital banking services

- The adoption of AI by leading financial institutions is growing steadily as they seek to manage business expenses

- Digital ecosystems are replacing traditional financial services

- Technology services are eyeing the financial services sector as the next frontier for growth and expansion

As you can see, your bank needs to become AI-first if you want to survive in the competitive financial services sector.

Sooner rather than later, every player in the industry will have to take up this innovative technology or they will be forced out of the industry as customers demand AI personalization financial services.

How AI Helps with Personalization for Financial Services

Let’s now take a look at the different ways you can use AI to personalize your customer experience.

Improve Your Digital Banking Experience

AI provides you with many opportunities to recognize your customers, provide personalized services and earn their loyalty by offering relevant suggestions that are based on past user behavior.

With AI, you can use transactional data as well as data from other sources to understand consumer behavior. You can then use insights from this data to encourage your customers to use your services more frequently.

For example, when a customer uses a card to pay for a flight, AI can help you suggest personalized offers for the customer such as recommending affordable hotels and taxi rides when they get to their destination. This can result in greater spending from the customer.

As AI makes it easier for you to analyze and understand user behavior, you can use this information to personalize your services and offers. The speed and ease of getting insights into your audience makes it possible to drive better brand awareness and sales.

Improve the Efficiency of Your Contact Center Employees

AI can also improve the efficiency of your contact center employees and allow them to take up a consultancy/advisory role. It also enables them to serve your customers better and faster.

Here’s how.

With AI-powered chatbots, you can answer common customer questions and handle basic calls such as updating user details. This will free up your contact center employees to handle complex issues and provide tailored advice about your services.

In addition, AI-driven insights into the customers can help them understand their needs better and serve them faster.

You can also use these customer interactions to collect additional lifestyle data for future planning and service improvement.

Enhance In-Person Interactions

Although customers appreciate the convenience of Al-driven personalization, most still want in-person interactions with their banks, and not through other modes.

Mobile banking apps and online platforms have revolutionized the way people bank, but most customers — especially the older generation — still seek banking services from banking halls.

While most of the talk has been about how technology can replace the core functions performed by bank employees in banking halls, AI stands out as a technology that can help banks serve their customers better.

How so?

Well, AI helps banks collect relevant user information that they can use to understand customer needs better. And when a customer shows up at the banking hall, the staff will reference the data collected through past digital transactions to offer personalized services.

Nordea Bank, for example, recently introduced AI technology that analyzes text queries made by customers. This information is then forwarded to the customer service employees who use it when interacting with in-person clients.

Preventing Fraud

Financial institutions can also use AI for fraud prevention. AI can help you analyze customer behavior and help you detect or anticipate fraudulent activities quickly.

Furthermore, you can also combine AI with online signature tools like DocuSign to authenticate transactions to prevent fraud.

Final Thoughts

In today’s competitive and ever-changing business environment, financial services brands must work harder to understand customers and engage them with relevant offers.

By implementing AI-driven personalization, financial services brands can leverage technology to provide enhanced services and run other initiatives that build customer loyalty.

The post How AI Drives Personalization in Financial Services: 4 Practices and Examples appeared first on Convince & Convert.

![Read more about the article How to Kill Assumptions and Make Marketing Predictable With John Readman From BOSCO [AMP 246]](https://www.dimaservices.agency/wp-content/uploads/2021/08/245_Justin-Zimmerman-Podcast-Graphics_header-2-300x128.png)