Imagine you’re considering taking a vacation, but you’re really on the fence about making the trip. You check flight prices for your preferred dates, and they’re just expensive enough to make you think twice, so you decide to sleep on it.

The next day, you look again — only to see that those borderline-too-much prices aren’t so borderline anymore. They’ve surged out of your price range as the flight filled up. Unfortunately, in this case, you’ve found yourself on the wrong side of a strategy known as dynamic pricing.

Let’s take a look at what that concept is, some examples of what it looks like in practice, and a picture of its perks and drawbacks.

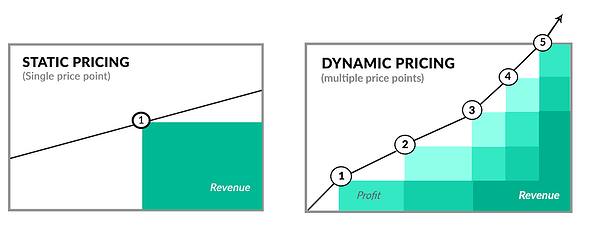

Dynamic pricing is a strategy aimed at maximizing profit off time-based opportunity. It’s the delicate practice of pinning down the right price to suit the right level of demand — operating at multiple price points, hoping to hit one that’s on par with however enthusiastic consumers are about your product or service at any given moment.

Here’s a graphic representation of the practice.

Image Source: Competitoor

Dynamic pricing can only be leveraged by businesses that fulfill certain requirements, including these key points.

- A business has to have the capacity to gauge how and when demand shifts. If a company has no reference points for or understanding of how its broader market fluctuates, it won’t be able to effectively adjust prices to suit changing demand.

- A business needs customers who are willing to pay non-static prices. Companies can’t expect to successfully use dynamic pricing if potential consumers have no interest in paying extra under certain circumstances. If an industry’s pricing structures are thoroughly established with consumers who stick to them stringently, there isn’t much room for the businesses that compose it to adjust their prices freely.

- A business needs sufficient market power when setting prices or industry peers also leveraging the practice. An organization can only set prices at will if it has a significant place in its market for consumers to be receptive to that change. If a relatively small business in a crowded industry decides to raise prices on a whim, it could easily be cast by the wayside. Unless a business carries some weight or dynamic pricing is a common practice in its space, it likely won’t do too much for that company.

Several businesses across a variety of industries fit the bill described above. Here are some examples of how the practice is employed.

Dynamic Pricing Examples

Hotels

Hotels adjust the price of rooms based on factors like availability and seasonality. For example, a hotel room in Northern New England will likely be more expensive during the fall when tourists are interested in seeing leaves change than it would be in the dead of winter when the area sees snow, making local attractions less accessible.

Uber Surges

Uber utilizes dynamic pricing with its surge feature. When demand for rides is higher and more competitive, the app will adjust rates accordingly — making rides more expensive to capitalize on that increasing need.

Utility Providers

Utility providers like gas and electric companies often leverage dynamic pricing — typically, in response to seasonal shifts. For instance, during summer, there’s a reduced need for indoor heating, so the price of electricity tends to fall.

Google Ads

The price of Google ads, created through programs like Google Adwords, varies by how popular an ad’s keyword is. If a company wants to place an ad that will rank well on Google for a subject that has a high search volume and several other businesses vying for placement, it will need to pay a higher price than it would for an ad surrounding a keyword that doesn’t garner much interest.

Dynamic pricing comes with its fair share of perks and drawbacks, including the following.

Pros of Dynamic Pricing

Employees can be paid a higher wage during busier times.

Dynamic pricing can give you the flexibility to reward and incentivize your employees during busier stretches. By adjusting prices to suit heightened demand, you can raise the funds to more freely increase wages accordingly.

You can still sell in downtimes.

When demand is lower, your sales tend to follow suit. Downtimes are down for a reason — people are simply less inclined to buy at some points. Dynamic pricing can help you salvage some business during those stretches. By lowering prices to suit lower demand, you’ll appeal to a broader base of consumers who aren’t willing to pay full price during inopportune time frames.

Cons of Dynamic Pricing

Your customers might feel cheated and trust you less.

Inconsistent pricing might get on your customers’ nerves. Constantly shifted prices can be frustrating. If consumers see what they believe to be a fair price on your product or service one day — only to have it radically shift on them the next — they might feel like you’re being too opportunistic or flat-out unfair.

You might lose business if you overdo it.

As an extension of the point above, overdoing dynamic pricing — specifically, excessively hiking prices during times of peak demand — you might lose out on some business and fail to see the returns you’re looking for. And once the dust settles and your price stabilizes, you might have ticked off your base enough to miss out on their business in the future.

Dynamic pricing is a delicate practice that only works in certain industries. That being said, it’s worth having an understanding of the concept. If your business meets the required elements to leverage it freely, you absolutely need to have a grasp on it.

And as a consumer, it helps to have a picture of how it works — getting a feel for the strategy might just save you some money when buying from companies that employ it.

![]()

![Read more about the article A Look at Sales Budgets & the 7 Steps to Creating One [+ Templates]](https://www.dimaservices.agency/wp-content/uploads/2021/06/4b901946-0edd-4506-b655-1956d3a8a60c-300x45.png)