Auto Added by WPeMatico

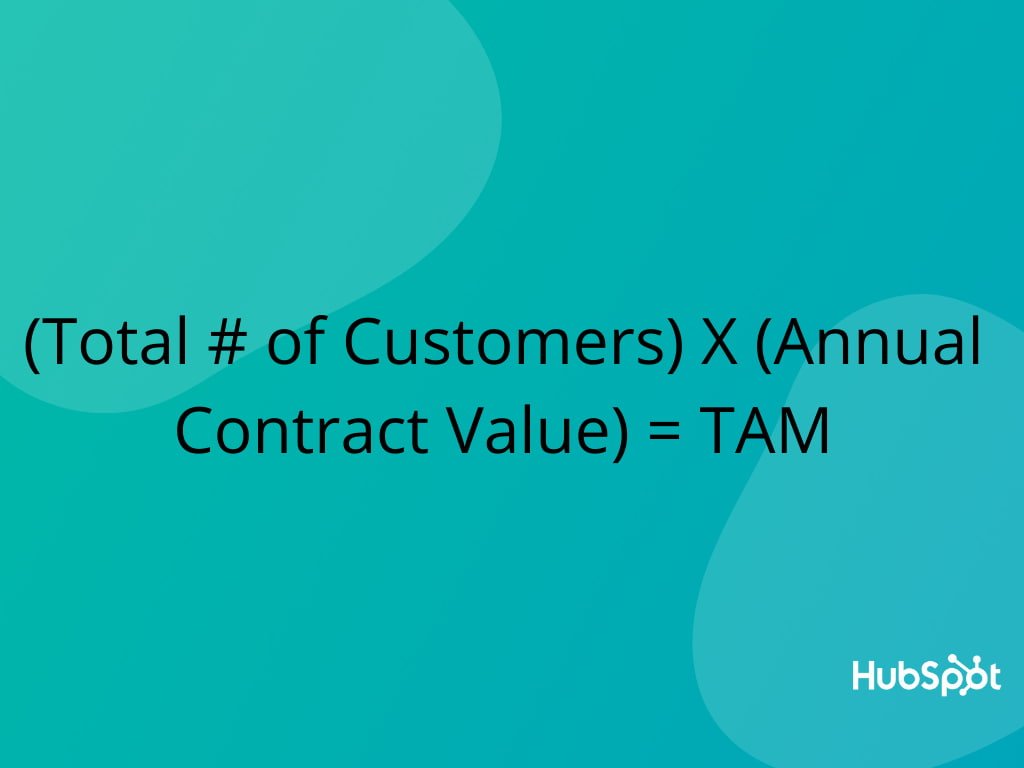

Total Addressable Market (TAM): What It Is & How You Can Calculate It

In college, I interned at a MarTech company that sold email marketing optimization software. With their software, brands could finally gain visibility into their email program’s deliverability rate or inbox…

![Read more about the article 3 Ways Data Privacy Changes Benefit Marketers [New Data]](https://www.dimaservices.agency/wp-content/uploads/2022/12/ebf9ec8e-a468-455a-943e-80aa4e6be694.png)

![Read more about the article The Beginner’s Guide to the Competitive Matrix [Template]](https://www.dimaservices.agency/wp-content/uploads/2022/07/b3ec18aa-f4b2-45e9-851f-6d359263e671.png)