Auto Added by WPeMatico

Zoom-to-Face: How to Digitally Walk Your Sales Floor

For a lot of organizations, the game plan for going remote amounted to, “Next week the office is closed.” Going forward, we have to take remote seriously if we…

Your Sales Team’s Mental Health Is Your Responsibility, Too. What Are You Doing About It?

Let’s face it. The term “mental health” is not one you’d typically hear discussed within sales meetings. Sales jobs have always been viewed as tough, demanding, highly metrics-driven and…

Ideation, Creation, Iteration: How to Align Sales and Marketing Content Output

Whether you’re sales or marketing, putting out content is a never-ending task, a mountain with no peak. With so much competition across, it takes more and more effort to…

Learn How to Sell Abroad With the Right Reflection, Planning, and Metrics

With uncertainty abound in the market, you may be keen to look elsewhere – including abroad. Even if your intention is global expansion, that doesn’t mean targeting a whole…

Celebrating One Year

Community is often referred to as a feeling of fellowship with others, or a tribe to go through life’s ups and downs with. When you felt helpless, uncertain and scared…

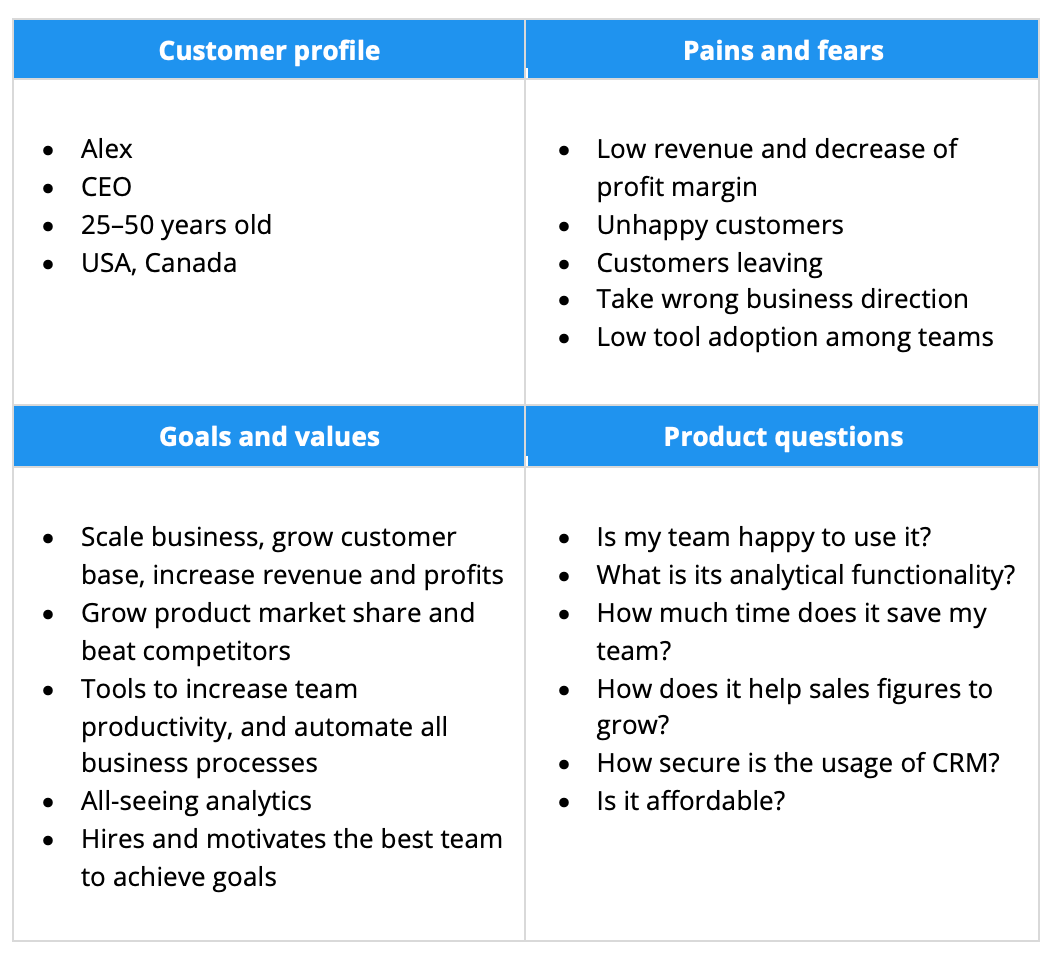

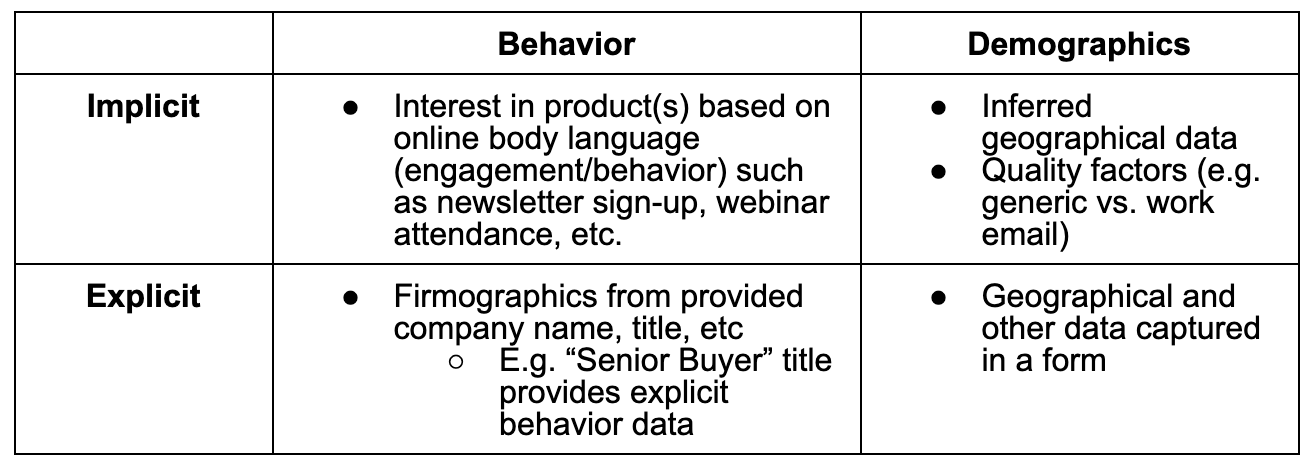

How to Calculate a Lead Score (With Examples)

Lead scoring is a key strategy for any business that wants to efficiently handle leads at scale. There comes a point when your focus shifts from getting enough leads…

Let’s Talk Talk Tracks: 15 Sales Enablement Leaders Share What Works (and What Doesn’t)

Are talk tracks just a fancy new tech take on sales scripts? Not according to these sales and sales enablement experts. Software tools are constantly improving their platforms with…

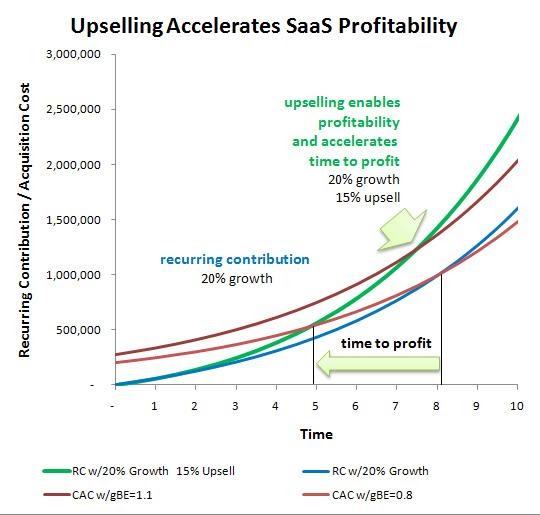

SaaS Case Study: How Customer Support Can Assist Sales Initiatives

As a SaaS business owner, you know that the competition is intense. For your brand to stand out, you have to provide an exceptional experience to your clients. The customer…

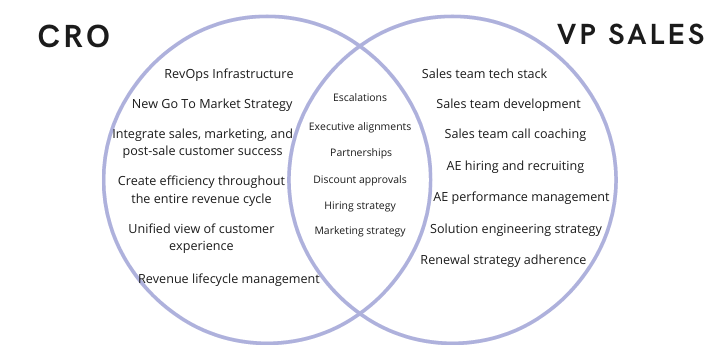

The Difference Between a VP of Sales and a CRO

We’re in the middle of a transformational time in the world of technology across all sectors. From B2C consumer-focused tech to the next B2B enterprise cloud giants, B2B, and B2C…