There’s a frustrating truth that every business deals with early into its growth: More money, more problems.

It seems counterintuitive — if sales and revenue are up, isn’t that a good thing? How are bigger profits a potential problem?

Put simply, it all comes down to the fact that the more you sell, the more money you need to spend. This includes marketing and sales campaigns to reach more customers, the production costs of more goods, and the time and money required for new product development.

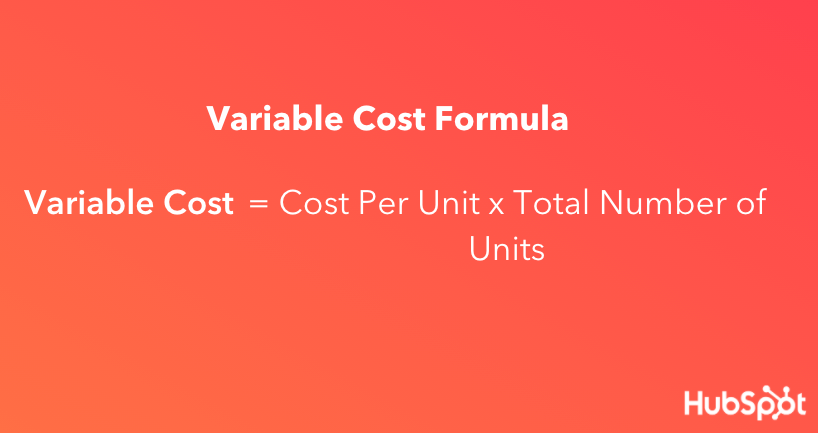

Known as variable cost, this sales/spend ratio is something every business owner should understand, but online advice listicles and action plans often assume readers have an intrinsic knowledge of this concept rather than providing a working definition.

In this piece, we’ll clear up variable cost confusion: Here’s what you need to know about variable costs, how to calculate them, and why they matter.

Let’s examine each of these components in more detail.

Variable Cost Per Unit

The variable cost per unit is the amount of labor, materials, and other resources required to produce your product. For example, if your company sells sets of kitchen knives for $300 but each set requires $200 to create, test, package, and market, your variable cost per unit is $200.

Number of Units Produced

The number of units produced is exactly what you might expect — it’s the total number of items produced by your company. So in our knife example above,if you’ve made and sold 100 knife sets your total number of units produced is 100, each of which carries a $200 variable cost and a $100 potential profit.

Variable costs earn the name because they can increase and decrease as you make more or less of your product. The more units you sell, the more money you’ll make, but some of this money will need to pay for the production of more units. So, you’ll need to produce more units to actually turn a profit.

And, because each unit requires a certain amount of resources, a higher number of units will raise the variable costs needed to produce them.

Variable costs aren’t a “problem,” though — they’re more of a necessary evil. They play a role in several bookkeeping tasks, and both your total variable cost and average variable cost are calculated separately.

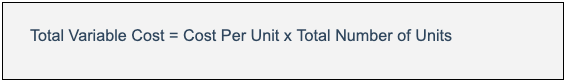

Total Variable Cost

Your total variable cost is the sum of all variable costs associated with each individual product you’ve developed. Calculate total variable cost by multiplying the cost to make one unit of your product by the number of products you’ve developed.

For example, if it costs $60 to make one unit of your product and you’ve made 20 units, your total variable cost is $60 x 20, or $1,200.

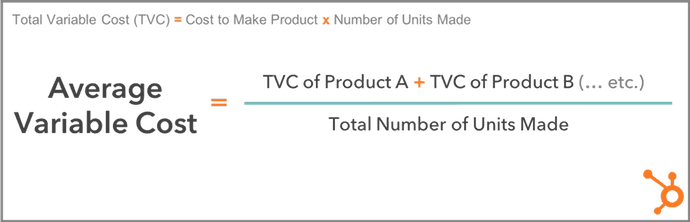

Average Variable Cost

Your average variable cost uses your total variable cost to determine how much, on average, it costs to produce one unit of your product. You can calculate it with the formula below.

Total Variable Cost vs. Average Variable Cost

If the average variable cost of one unit is found using your total variable cost, don’t you already know how much one unit of your product costs to develop? Can’t you work backward, and simply divide your total variable cost by the number of units you have? Not necessarily.

While total variable cost shows how much you’re paying to develop every unit of your product, you might also have to account for products that have different variable costs per unit. That’s where average variable cost comes in.

For example, if you have 10 units of Product A at a variable cost of $60/unit, and 15 units of Product B at a variable cost of $30/unit, you have two different variable costs — $60 and $30. Your average variable cost crunches these two variable costs down to one manageable figure.

In the above example, you can find your average variable cost by adding the total variable cost of Product A ($60 x 10 units, or $600) and the total variable cost of Product B ($30 x 15 units, or $450), then dividing this sum by the total number of units produced (10 + 15, or 25).

Your average variable cost is ($600 + $450) ÷ 25, or $42 per unit.

Variable vs. Fixed Cost

The opposite of variable cost? Fixed cost. Fixed costs are costs that don’t change in response to the number of products you’re producing.

Some common fixed costs include renting or leasing a building, utility bills, website hosting, business loan repayments, and property taxes.

Worth noting? These costs aren’t static — meaning, your rent may increase year over year. Instead, they remain fixed only in reference to product production.

To calculate the average fixed cost, use this formula:

Both variable and fixed costs are essential to getting a complete picture of how much it costs to produce an item — and how much profit remains after each sale.

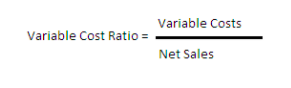

To calculate variable cost ratio, use this formula:

Let’s put it into practice. If you’re selling an item for $200 (Net Sales) but it costs $20 to produce (Variable Costs), you divide $20 by $200 to get 0.1. Multiply by 100 and your variable cost ratio is 10%. This means that for every sale of an item you’re getting a 90% return with 10% going toward variable costs.

Combining variable and fixed costs, meanwhile, can help you calculate your break-even point — the point at which producing and selling goods is zeroed out by the combination of variable and fixed costs.

Consider our example above again. If your variable costs are $20 on a $200 item and your fixed costs account for $100, your total costs now account for 60% of the item’s sale value, leaving you with 40%.

Put simply? The higher your total cost ratio, the lower your potential profit. If this number becomes negative, you’ve passed the break-even point and will start losing money on every sale.

So, what’s considered a variable cost to the business?

Some of the most common variable costs include physical materials, production equipment, sales commissions, staff wages, credit card fees, online payment partners, and packaging/shipping costs.

Let’s examine each in more detail.

Physical Materials

These can include parts, cloth, and even food ingredients required to make your final product.

Production Equipment

If you automate certain parts of your product’s development, you might need to invest in more automation equipment or software as your product line gets bigger.

Sales Commissions

The more products your company sells, the more you might pay in commission to your salespeople as they win customers.

Staff Wages

The more products you create, the more employees you might need, which means a bigger payroll, too.

Credit Card Fees

Businesses that receive credit card payments from their customers will incur higher transaction fees as they deliver more services.

Online Payment Partners

Apps like PayPal typically charge businesses per transaction so customers can check out purchases through the app. The more orders you receive, the more you’ll pay to the app.

Packaging and Shipping Costs

You might pay to package and ship your product by the unit, and therefore more or fewer shipped units will cause these costs to vary.

Expect the Unexpected

While variable costs, total variable costs, average variable costs, and the variable cost ratio often seem complicated on the surface, these terms are simply ways to represent the changing nature of costs to produce new items as your business grows.

By understanding the nature of these costs and how they impact your current and projected revenue, it’s possible to better prepare for evolving market forces and reduce the impact of variable costs on your bottom line.

![]()

![Read more about the article What is a Letter of Intent? How to Write One for a Job [+ Examples]](https://www.dimaservices.agency/wp-content/uploads/2024/03/0883861a-7887-4f9f-ab4b-14e6341c1525-300x39.png)