Whether you’re a sales leader, manager, or rep, metrics are key to your success. They help you evaluate the performance of the business, team, and individual contributors.

Let’s say you’re preparing for a meeting with your VP of Sales. In this meeting, you need to provide an update on your sales team’s achievements. If you’re looking at the surplus of dashboards and reports in your CRM database, all the charts, numbers, and percentages can be overwhelming.

Which sales metrics reflect the largest business impact? Are there certain ones you should prioritize?

One metric that you should analyze is monthly recurring revenue (MRR). It tells you and your VP how much income is generated each month. Not only can you look at revenue trends over time, but you can also compare MRR to the monthly sign up rate for your product or service, monthly account growth rate, and customer retention.

An MRR analysis will tell you if your revenue is shrinking or growing over time, plus, it informs sales leaders so they can make educated business decisions.

What Is MRR?

MRR stands for monthly recurring revenue. It’s a normalized measure of a business’ predictable revenue that it expects to earn each month. For example, if you have 10 customers and they pay you $50 per month, your MRR would be $500.

Before we get started, let’s define some terms.

- Revenue: The income your business earns in return for the sales of goods and services.

- Recurring Revenue: This is the income you can expect to earn on a regular basis. Recurring revenue can be measured on a monthly or yearly basis (e.g., MRR: monthly recurring revenue, ARR: annual recurring revenue).

So, what does MRR look like in practice?

Picture this: You work for a cloud computing company that sells a cloud photo storage platform. Customers sign a contract for a yearly subscription and they pay a monthly fee to use the photo storage service.

Let’s say the client has agreed to pay $1,200 per year, and based on their purchase you can expect to earn $100 ($1,200/12 months) in income each month. The monthly recurring revenue (MRR) for this customer is $100.

Once you’ve calculated the MRR for each customer, you can calculate the total MRR for your business.

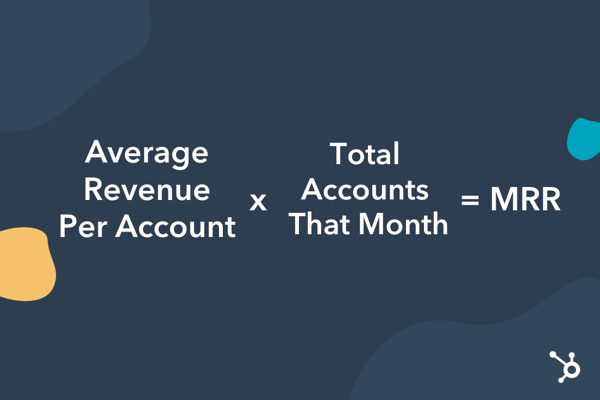

MRR Formula

Average Revenue Per Account (ARPA) is the crucial metric when calculating MRR. You arrive at that figure by taking the average of how much all of your customers are paying and dividing it by the total number of customers that month.

To determine your MRR, you multiply that figure by your total number of customers. So, if you have 100 customers paying an average of $50 per month, your MRR would be $5,000.

There are other methods you can use to calculate MRR. Depending on which one your business chooses, the formula will vary.

For instance, your business can use the customer-by-customer method. With this formula, you combine the monthly payments of all your customers. If you had 90 customers that paid you $10 each month, the MRR would be $900.

The customer-by-customer method might be less efficient than the ARPA method, but both equations should still bring you to the same figure.

But, what does that figure mean? And how can it be applied? There’s no single answer to either of those questions. That’s because MRR can be partitioned, dissected, and analyzed in different contexts for different purposes.

Types of MRR

Breaking MRR down even further will help you look at revenue growth and trends to see if there are any areas you could improve upon.

1. New MRR

New MRR is the monthly recurring revenue that’s generated from brand new customers. Let’s say you have 10 new customers in a month, half of them pay $50/month and the other half pays $100/month — new MRR would be $750.

2. Expansion MRR

This number represents additional monthly recurring revenue from your existing customers. Expansion MRR is also known as an upgrade and can also result from an upsell or cross-sell. Using the example above, if four customers upgrade their contracts from $50 to $100/month — expansion MRR would be $200.

3. Churn MRR

Churn MRR is the revenue that’s been lost due to customers canceling or downgrading. So if one customer cancels their $50 subscription and three downgrade their monthly subscription from $100 to $50/month, the churn MRR would be $200. And this means you’ll have less MRR to work with, in the upcoming months.

4. Net New MRR

This amount is calculated using the three MRR types above. Here is the net new MRR formula:

Net New MRR = New MRR + Expansion MRR – Churned MRR

The result of the calculation will tell you how much MRR you’re gaining or losing. If the sum of new MRR and expansion MRR is less than churned MRR, then you lost money. But if they’re greater than churn MRR, you’ve gained money.

Why is MRR Important?

While MRR might seem like a big picture metric that impacts the business high-level, it’s just as important to individual sales reps as it is for management.

“MRR is the most important metric for financial growth. There are other important metrics like growth rate, retention, average sales price, and rep productivity, but at the end of the day, the most important metric is the amount of monthly recurring revenue customers are willing to put on their credit card or pay through an invoice,” says Dan Tyre, sales director at HubSpot. “We judge the performance of our companies, divisions, teams, down to the individual performer based on MRR attainment. It’s a foundational metric for examining team and sales rep performance.”

1. Tracking Performance

How large are the deals that you’re closing? MRR allows salespeople to see the size of the accounts they manage. If you earn a commission based on the monthly recurring revenue you close, your take-home pay could be impacted depending on the proportion of high and low MRR customers you’ve sold to.

Are you struggling to hit your MRR quota each month? Take a look at the deals with high MRR you’ve closed.

- Are there any similarities between the clients that have purchased from you?

- Was there anything you did throughout the sales cycle that positively impacted the sale?

Reflecting on these details will help you modify your sales approach for the opportunities in your pipeline. And hopefully, your analysis will result in you closing high-MRR deals.

2. Sales Forecasts

Just as reps can look at their individual performance, sales managers and leaders can look big picture and see how the team is doing as a whole. By looking at the total MRR, they can make more accurate sales forecasts and projections. And this helps the sales team plan for growth in the short-term and long-term.

3. Budgeting

Without a steady income stream, it’s difficult to run a successful business. MRR tells business leaders how much money is coming in each month that can be reinvested.

Will you be able to hire more business development representatives this month? Can you run that lead generation campaign? The amount of revenue you’re bringing in is one of the deciding factors in these situations.

If you’re struggling to make ends meet, you can also identify any trends in MRR over time that might indicate financial trouble.

But, if monthly recurring revenue is trending upwards, MRR can be a source of motivation for your sales team. As your sales reps build momentum and close high MRR deals, they’ll be engaged in their roles and eager to close more.

MRR is a key metric for business planning and decision making. To learn more, check out the other most important sales metrics next.

Editor’s note: This post was originally published in March 3, 2019 and has been updated for comprehensiveness.

![]()